Investing in gold has always been a wise choice for those looking to preserve and grow their wealth. Gold bars, in particular, offer a tangible and reliable form of investment that has stood the test of time. In this article, we will explore the benefits of buying gold bars, how to purchase them, and why they remain a popular choice among investors.

Why Buy Gold Bars?

Preservation of Wealth: Gold has historically been a stable store of value, maintaining its purchasing power over time. Unlike fiat currencies, which can be subject to inflation and buy gold bars devaluation, gold's intrinsic value remains consistent, making it an ideal hedge against economic uncertainty.

Diversification: Adding gold bars to your investment portfolio helps diversify your assets, reducing risk. Gold often performs well during market downturns, providing a buffer against losses in other investments such as stocks and bonds.

Liquidity: Gold bars are highly liquid assets. They can be easily bought or sold in markets around the world, ensuring that you can quickly convert your investment into cash when needed.

Tangible Asset: Unlike digital or paper assets, gold bars are physical and tangible. This gives investors a sense of security and control over their investment.

How to Buy Gold Bars

Purchasing gold bars involves several key steps to ensure you are making a wise and secure investment.

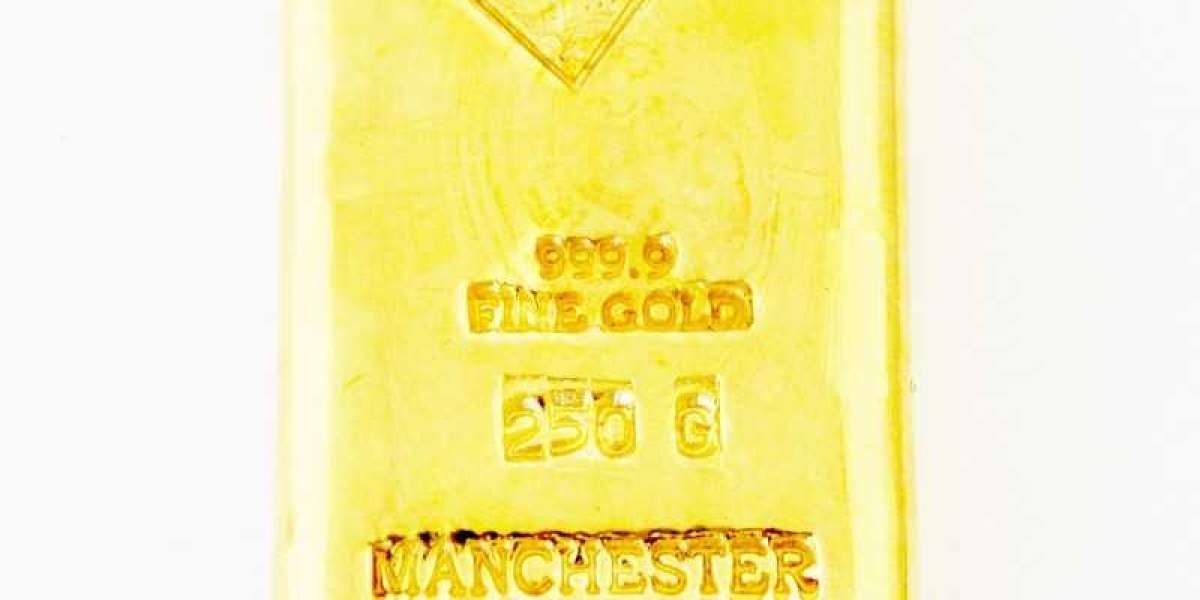

Choose a Reputable Dealer: Selecting a reputable dealer is crucial when buying gold bars. Look for dealers with a solid reputation, good customer reviews, and accreditation from industry organizations. This ensures that you are purchasing genuine gold bars of the stated purity and weight.

Determine Your Budget and Goals: Before buying gold bars, consider your investment goals and budget. Gold bars come in various sizes, ranging from 1 gram to 1 kilogram or more. Smaller bars are more affordable and easier to sell, while larger bars may offer lower premiums over the spot price of gold.

Verify Purity and Weight: Ensure that the gold bars you purchase are of high purity, typically 99.99% (24 karats). Reputable dealers provide certificates of authenticity and assayer's marks to verify the purity and weight of the gold bars.

Understand the Costs: In addition to the spot price of gold, you will need to consider premiums, which are additional costs over the spot price. Premiums cover manufacturing, distribution, and dealer profits. Compare premiums from different dealers to get the best value for your money.

Secure Storage: Once you buy gold bars, it's essential to store them securely. Options include home safes, bank safety deposit boxes, or specialized gold storage facilities. Ensure that your storage location is safe and adequately insured.

Where to Buy Gold Bars

There are several options for purchasing gold bars:

Online Retailers: Many online platforms specialize in selling gold bars. These retailers offer a wide range of sizes and brands, allowing you to compare prices and read customer reviews. Ensure that the online retailer is reputable and offers secure payment methods and insured shipping.

Local Dealers: Local coin shops and bullion dealers can provide a more personal buying experience. Visiting a local dealer allows you to inspect the gold bars before purchase and ask any questions directly.

Banks and Financial Institutions: Some banks and financial institutions sell gold bars to their customers. This option may offer additional security and peace of mind, as well as the convenience of purchasing through a trusted financial entity.

Auctions and Estate Sales: Gold bars can sometimes be found at auctions and estate sales. While this option may offer lower prices, it also carries higher risks. Ensure that you verify the authenticity and purity of the gold bars before purchasing.

Conclusion

Buying gold bars is a strategic investment that offers numerous benefits, including wealth preservation, portfolio diversification, liquidity, and tangibility. By choosing a reputable dealer, understanding the costs, and securing proper storage, you can confidently add gold bars to your investment portfolio. As a timeless and stable asset, gold bars continue to be a smart choice for investors seeking stability and growth in an ever-changing economic landscape.